Gehaltsrechner 1.15.0

Continue to app

Free Version

Publisher Description

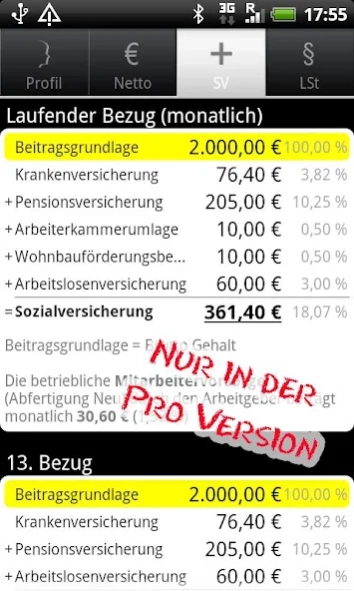

Gehaltsrechner - Gross > Net salary calculator for Austria (tax year 2011 to 2021)

Tax year 2011 to 2021 - calculate your net salary from the gross easily, quickly and anywhere. This salary calculator for Austria does not require an active internet connection for the calculation.

** Further development was discontinued in 2021 **

The app will remain available, but there will be no more adjustments to the contribution law values after 2021!

calculate from:

- Net salary (from gross)

- Social security contribution

- Income tax

- Effective tax ratio of the gross

- How long a year do I work for the community

- Where does the tax euro go?

for:

- Employee

- worker

- Freelancers

- public servants

- Apprentices

the:

- ongoing purchase (monthly)

- 13th payment (holiday pay)

- 14th withdrawal (Christmas bonus)

- Annual reference

the years:

- 2021

- 2020

- 2019

- 2018 (1st and 2nd half of the year)

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

- 2011

optionally adjustable:

- commuter allowance

- benefits in kind

- Income tax allowance

- Sales amount for children (AVAB)

- Family bonus plus from 2019 (only in the Pro version)

Calculations for information purposes only and without guarantee! Please rate fairly if you do!

More functions:

- Send and share the results (text)

- Memorize the last selection

Required Permissions:

- Network communication: For the advertising banner in the free version.

** COMMUNITY QUESTIONS **

1. Why is overtime not taken into account?

ANSWER: Irregular overtime, which is only billed afterwards, does not belong to a salary calculator that extrapolates from the monthly to the annual salary. Apart from that: overtime is regulated by the respective collective agreement. There are over 450, and typically in Austria, everyone also knows many exceptions. Unfortunately, calculating this is beyond the scope of each application.

However, a fixed overtime fee can already be included in the calculation, either free of wage tax or as a special payment, depending on the specification.

2.) Why are no federal states selectable?

ANSWER: Since it is irrelevant for the employee wage calculation (gross net). This would only be necessary for the employer's non-wage labor costs (which this app does not calculate).

About Gehaltsrechner

Gehaltsrechner is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Gehaltsrechner is RESDAC. The latest version released by its developer is 1.15.0.

To install Gehaltsrechner on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2021-03-04 and was downloaded 0 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Gehaltsrechner as malware as malware if the download link to at.resdac.taxfee is broken.

How to install Gehaltsrechner on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Gehaltsrechner is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Gehaltsrechner will be shown. Click on Accept to continue the process.

- Gehaltsrechner will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.